BtS Vol 1, Issue 13 | Africa-China Debt Relationship: A ticking time bomb

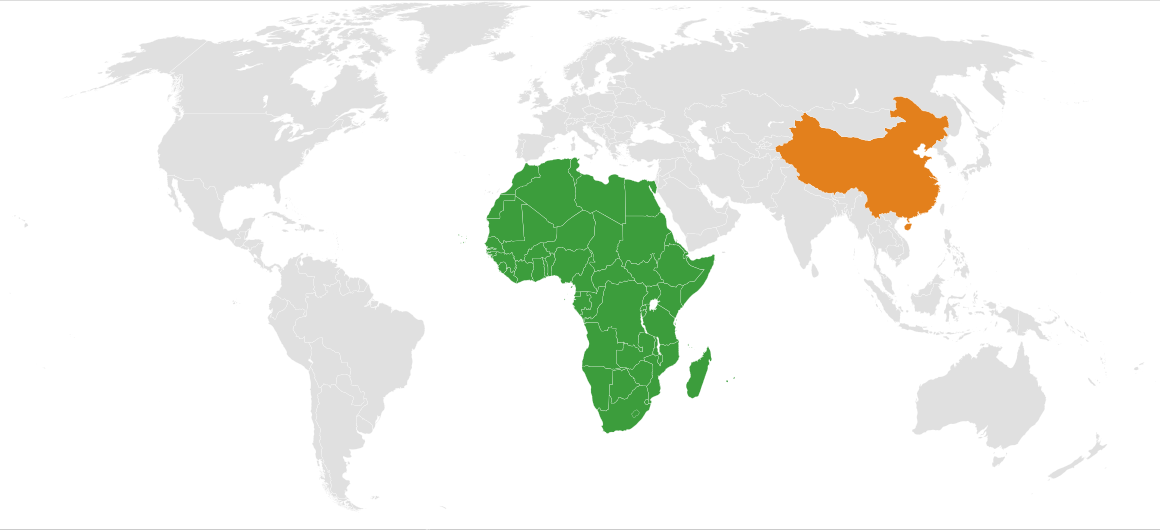

Sino-African relations predate the 21st century, but an increased focus on establishing long-term relationships began in 1996 when then-President, Jiang Zemin, assembled other Chinese dignitaries for bilateral dialogue across the continent. Since 1996, China’s involvement in Africa’s economy, trade, and infrastructure has grown exponentially. For context, the trade volume in 2000 was earmarked at $10.6bn; in 2019 the General Administration of Customs of the PRC valued the Multilateral Corporation at $192bn.

China has positioned itself as Africa’s biggest partner, with the most robust foreign aid programme under the Belt and Road Initiative (BRI). The Chinese government offers investment in the continent through commercial, concessional loans and export credits. This unique foreign policy approach throughout the continent especially with infrastructural funding meets the needs of most Africans whereas the Chinese require less stringent requirements than other multilateral organisations like the IMF and World Bank demand.

Most development economists and policy analysts have raised concerns about the ballooning debts from Africa (China is estimated to hold 21% of African debt) plunging future governments and unborn generations to unserviceable debt. Politically, for Africa’s large voting bloc, China sees the region as a playground for testing its political ideology, the so-called “China Model” – where African countries can be relied on for support at the United Nations for China’s political agenda.

With context to the Chinese playbook and a looming debt trap, it is on this premise that StateCraft Inc. makes the following recommendations to African leaders:

- Redefining Debt: The concept of debt around many African communities has negative connotations, but all debts must be tied to purpose. We see very frequently African governments take Chinese loans to fund recurrent expenses (facilitating the payment of salaries/wages or procurement of luxurious vehicles for cabinet), or ambitious infrastructure projects that have no immediate revenue generation model. African leaders, their ministers and advisers must begin to turn to domestic creditors in facilitating long-term financial projects.

- Asset Collateral: As Africa’s largest creditor, China provides favourable terms for loans, but when debts are not repayable, lucrative assets are seized as collateral. Sri Lanka’s Hambantota port where China turned the debt to a 99-year lease is a cautionary tale to African leaders. Governments must ensure agreements are properly scrutinized and less lucrative assets are put up as collateral.

- Debt Relief: With the COVID-19 pandemic and its damming impact on economies across the world, where revenue has shrunk, African governments must commence high-level negotiations on collective debt relief or debt restructuring.